Summary

South Korea’s crypto landscape has been reshaped by major political and regulatory changes since late 2024. Following President Yoon Suk-Yeol’s impeachment and Lee Jae-Myung’s election, the policy stance remains broadly supportive of digital assets, but implementation is still in early stages.

The government is focusing on key priorities such as introducing a KRW-pegged stablecoin, developing a domestic spot ETF framework, establishing a taxation framework, and enhancing other related services, including lending and leveraged trading.

Korea’s Web3 ecosystem is evolving rapidly, shaped by three defining trends. The Kimchi Premium has shown unusual patterns, at times turning negative. The rise of the “Meet-Up Meta” has fueled offline events and airdrops but also triggered backlash over fairness. Meanwhile, listing pumps remain a dominant force, highlighting the market’s highly speculative and retail-driven nature.

Welcome to Part II of our “State of the Korean Crypto Market” series. If you’d like background on the regulatory history and market foundations, please refer to Part I.

1. Introduction

The Korean crypto market has undergone rapid shifts since late 2024, shaped by political turbulence, evolving regulation, and changing retail dynamics. Following the impeachment of President Yoon Suk-Yeol and the election of Lee Jae-Myung, the policy environment remains broadly supportive of digital assets, but implementation is still in its early stages. Meanwhile, the domestic Web3 landscape continues to oscillate between speculation-driven activity and early signs of institutionalization, setting the stage for significant structural changes ahead.

2. After the Election: Korea’s Crypto Policy Outlook

In late 2024, South Korea faced heightened political uncertainty that briefly rippled through the crypto market. Following former President Yoon Suk-Yeol’s impeachment, finalized on April 4, 2025, a snap presidential election was held on June 3, resulting in the victory of Lee Jae-Myung over conservative rival Kim Moon-soo.

For the crypto industry, the outcome mattered less than the consensus: both candidates campaigned on similarly crypto-friendly platforms. Their agendas emphasized three key priorities — introducing a KRW-based stablecoin, setting a national crypto basic law, and establishing a domestic spot ETF framework.

While it has been just over four months since Lee took office and concrete policy outcomes remain limited, the bipartisan alignment signals a structural shift: digital assets have moved from a niche topic to a recognized pillar of Korea’s broader economic strategy.

Figure 1: Virtual Asset Presidential Election Pledges

Source: Presto research

Category | Lee Jae-myung (Democratic Party) | Kim Moon-soo | Lee Jun-seok |

Core Message | Strengthening youth asset formation; promoting stablecoin adoption; emphasizes need for crypto-friendly digital finance policy and regulatory clarity. | Announced 7 key pledges: Allowance of spot ETFs, abolishment of the one bank/ one exchange policy, clearer stablecoin regulations, institutional investor protection, STO legalization, tax reforms, and a comprehensive market infrastructure overhaul. | Strengthening AML/KYC measures and tax transparency; aims for a principle-based market structure prioritizing transparency and fairness over rigid regulation. |

Spot ETF Introduction | Pushes for Bitcoin and other spot crypto ETFs to be listed domestically; proposes youth-focused asset growth and tax incentives to encourage participation. | Supports domestic listing of spot ETFs for Bitcoin and other crypto assets; ties ETF introduction to broader financial inclusion and institutional access. | Open to Bitcoin ETFs under a framework that ensures market security and investor protection. |

Integrated Monitoring System | Plans to introduce a real-time integrated monitoring system for exchanges, custodians, and investment platforms to enhance investor protection. | No specific stance mentioned. | Focuses on strengthening AML/KYC requirements and enhancing transparency across exchanges and custodians rather than introducing a new centralized system. |

Transaction Fee Regulation | Proposes tightening regulation on excessive trading fees, listing commissions, and spreads to protect retail investors. | No specific stance mentioned. | No specific stance mentioned. |

One Bank/ One Exchange | Discussed easing the regulations, but due to financial market instability and money laundering risks, supports the current framework. | Strongly supports abolishing the one bank one exchange policy to encourage market competitiveness; also suggests a more transparent process | No specific stance mentioned. |

Stablecoin Policy | Plans to support stablecoin innovation and integration into financial services; promotes guidelines for transparency and reserves management. | Proposes a robust stablecoin framework with strict disclosure, reserve audits, and investor protection standards. | Advocates for stablecoin regulation focusing on market stability; emphasizes scenario-based stress testing and stricter issuance risk controls. |

Institutional Investment Rules | Encourages institutional investment into crypto via a government- backed framework, focusing on facilitating pension funds and large-scale investment vehicles. | Proposes loosening restrictions for institutional investors under a regulated framework; aims to enable broader participation. | No specific stance mentioned. |

Security Token Offerings (STO) | Proposes legalizing issuance and trading of security tokens (STOs), including a clear regulatory framework to attract institutional capital. | Supports STO legalization as part of broader capital markets reform; plans to introduce specific rules for STO registration and trading. | Supports STO adoption under enhanced transparency and investor protection measures. |

2.1. KRW Stablecoin

Debate over a KRW-pegged stablecoin has dominated the Lee Jae-myung administration’s opening months. On June 10, ruling Democratic Party lawmakers tabled the “Digital Asset Basic Act” (a.k.a. General Act on Digital Assets), laying the groundwork for an FSC-run licensing regime for KRW stablecoin issuers.

Figure 2: KRW-Pegged Stablecoin Table

Source: Presto Research

Proposal Area | Key Details | Objective |

Legislative Framework | Digital Asset Basic Act (tabled June 10, 2025) | Establish regulatory clarity and oversight |

Licensing Regime | FSC to manage licensing for KRW stablecoin issuers | Ensure government-supervised issuance |

Capital Requirements | Minimum equity capital between ₩500M ~ ₩5B | Ensure issuer solvency and risk mitigation |

Reserve Requirements | 100% high-quality reserves mandated | Guarantee full backing and stability |

Custody & Segregation | Customer assets must be segregated with bank custodians | Protect investor funds and reduce counterparty risk |

Attestations & Audits | Periodic reserve attestations and third-party audits required | Enhance transparency and trust |

Strategic Goal | Promote a KRW-regulated stablecoin as an alternative to USD stablecoins | Keep liquidity onshore and strengthen domestic markets |

The FSC says it’s preparing a dedicated KRW stablecoin bill for October 2025 as part of “Phase 2” of the Virtual Asset User Protection Act, which should spell out issuance, collateral management, and internal-control requirements. Press briefings and industry trackers over the past two weeks have repeated the October target.

Stance from The Bank of Korea

The Bank of Korea has stayed cautious. In public remarks in late June and July, officials reiterated that KRW stablecoin issuance should start only with tightly regulated commercial banks and be phased in gradually, citing FX and financial-stability risks. Governor Rhee also flagged that easy convertibility could intensify dollar demand; senior deputies have floated giving the BoK a de-facto veto on licenses. This BoK-first, banks-first approach contrasts with lawmakers’ push to allow qualified non-banks under FSC licensing, and it remains the core policy divide. Notably, the BoK has also paused parts of its CBDC work amid this pivot toward bank-led private stablecoins.

2.2. Spot ETFs

Momentum is rapidly building behind Korea’s domestic spot crypto ETF framework. In June, the FSC submitted a comprehensive implementation plan—including Bitcoin and potentially Ethereum ETFs—to the Presidential Committee on Policy Planning, aiming for a regulated launch in H2 2025.

Figure 3: Proposed Spot Crypto ETF Framework (as of June 2025)

Source: Presto Research

Category | Details | Objective / Implications |

Regulatory Body | Financial Services Commission (FSC) | Centralized oversight of ETF products |

Timeline | Targeted launch in H2 2025 | Accelerate crypto market institutionalization |

Scope | Spot ETFs for Bitcoin and potentially Ethereum | Introduce regulated investment vehicles |

Implementation Plan | Submitted to the Presidential Committee on Policy Planning | Formal policy approval required |

Legislative Path | Amendments to the Capital Markets Act | Explicitly permit crypto-based ETFs |

Key Requirements | • Licensed custody systems | Build robust infrastructure and investor safeguards |

Integration with Digital Asset Basic Act | Part of the broader Digital Asset Basic Act initiative | Consolidates digital asset regulations, reclassifies crypto firms as venture companies, and sets the foundation for ETF + stablecoin rollout |

Industry Readiness | Roundtables and consultations highlight: | Aligns regulatory framework with market infrastructure |

Sandbox Pilot Status | Mid-July sandbox proposal for private-fund crypto exposure was withdrawn | Signals formal statutory reform is essential for ETF approval |

The FSC’s crypto ETF roadmap underscores Korea’s push to institutionalize digital assets while maintaining strict investor protections. Unlike previous ad-hoc sandbox experiments, this effort ties directly to formal statutory reform, suggesting that regulatory clarity will be a prerequisite for meaningful ETF market development.

2.3. Lending

In early July, Upbit introduced a coin-lending service allowing users to borrow up to 80% of their holdings in USDT, BTC, or XRP, while Bithumb soon followed with leveraged loans offering up to 4x the value of collateral.

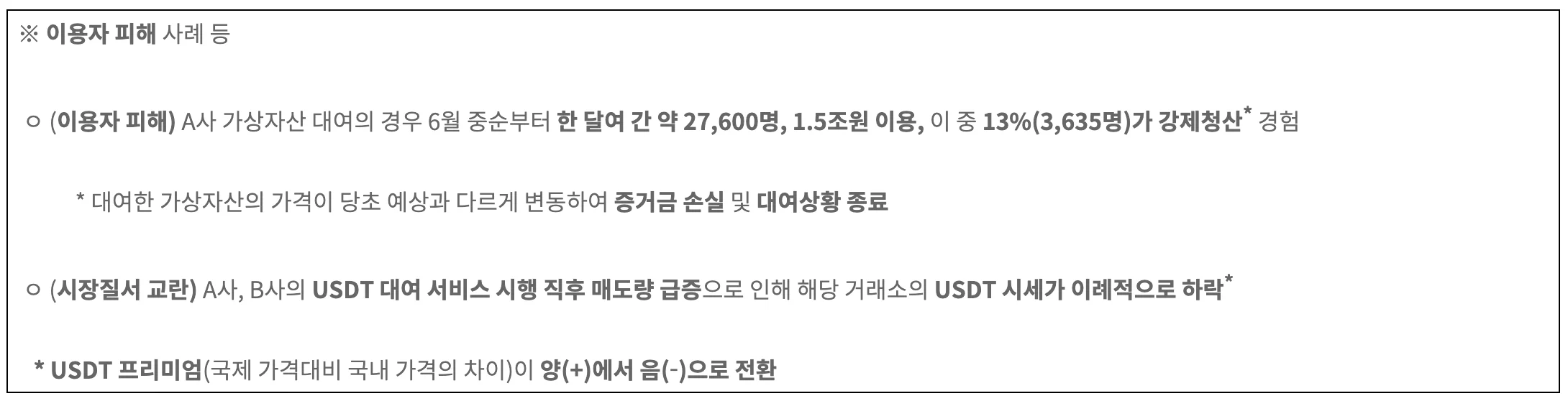

However, concerns mounted quickly: within just one month, on one exchange, approximately 27,600 investors had borrowed around ₩1.5 trillion (~$1.1 billion), and about 13% of these borrowers faced forced liquidation as asset prices plunged. Simultaneously, aggressive USDT selling temporarily distorted stablecoin prices across domestic exchanges.

Figure 4: Financial Services Commission (FSC) Issues Administrative Guidance (in Korean)

Source: Financial Services Commission

In response, on July 31, the Financial Services Commission (FSC) issued administrative guidance instructing all domestic exchanges to halt all new crypto lending activities—citing systemic risks and the undefined regulatory status of such services.

Both Upbit and Bithumb complied promptly: Upbit suspended its USDT lending, while Bithumb scaled back its offerings under stricter parameters. Meanwhile, exchanges such as Korbit and Coinone paused their planned launches amidst regulatory uncertainty.

Under the FSC’s directive:

- Existing lending contracts remain valid and may proceed, with users allowed to repay or extend maturity dates.

- No new lending services may be launched until further notice.

- Inspections will be conducted for any exchanges that fail to comply.

According to the guideline published on September 5, 2025, the FSC outlined a draft regulatory framework expected to be introduced—possibly by early 2026. This forthcoming framework is anticipated to cover:

- Leverage limits

- User eligibility criteria

- Risk disclosure requirements and transparency standards for virtual asset lending.

Until formal legislation or regulatory frameworks are enacted, the sector remains in a regulated pause, highlighting that only statutory reform, rather than regulatory flexibility, can support a meaningful and safe return of crypto lending services.

2.4. Tax

Crypto taxation has been postponed once again. In December 2024, the National Assembly approved a two-year deferral, shifting the implementation date to January 1, 2027. The framework remains largely unchanged. Profits exceeding ₩2.5 million will be taxed at a flat 20% rate, or 22% inclusive of local surtaxes, and taxpayers will be permitted to offset capital losses against gains within the same fiscal year.

3. Korea’s Web3 Outlook: Retail Behavior and Market Dynamics

3.1.Kimchi Premium

The Kimchi Premium, long considered a leading sentiment indicator for Korea’s crypto market, has behaved very differently in 2024–2025 compared to previous cycles. Historically, during bull markets, Bitcoin and major altcoins traded at a 2–5% premium on Korean exchanges, with spikes above 5% driven by heavy retail inflows and strong domestic buying pressure.

In 2025, that pattern shifted. On February 3, amid sharp global Bitcoin sell-offs, the Kimchi Premium briefly surged to around 10–12%, its highest level in three years. Unlike prior cycles — where premiums reflected strong buying demand during bullish conditions — this spike was driven instead by lower selling activity on Korean exchanges relative to offshore markets. In other words, the premium widened not because Korean retail was buying aggressively, but because local selling pressure was weaker during a global downturn.

By mid-July, the Kimchi Premium flipped negative for the first time in recent memory, with Bitcoin trading at a ~−2% discount on Korean exchanges between July 8–20. This trend persisted into early August, when Bitcoin traded at a −1.23% premium, while ETH, SOL, and XRP also hovered around −1.1% discounts.

Two factors explain this narrowing:

1. Lower domestic retail participation compared to prior bull cycles, reducing upward price pressure.

2. Improved cross-border arbitrage efficiency, accelerated by the introduction of $USDT trading pairs on Korean exchanges, which made it easier for participants to close pricing gaps.

Figure 5: Kimchi Premium Has Recently Traded in Negative Territory

Source: Trading View

3.2. Meet-Up Meta

One of the defining trends in Korea’s Web3 scene this season has been the rise of the “Meet-Up Meta.” With Korea’s highly active retail base, numerous pre-TGE projects have chosen to host offline meetups in Seoul ahead of their token launches, using these events to build community and generate hype. Crucially, many of these gatherings included token airdrops for participants, which intensified both excitement and controversy.

Eclipse became one of the most prominent examples. Ahead of its TGE, the project held a large-scale meetup where attendees reportedly received 2,551 ES tokens each. However, backlash followed quickly as the distribution heavily favored one-day event participants over testnet users and early ASC NFT holders. Many in the community criticized the approach, arguing that it rewarded speculative attendance rather than long-term contribution and created imbalances in token allocation.

A similar debate erupted around Sonic, which hosted an airdrop event in July alongside its Season 1 launch. A viral video showing tokens being thrown into the crowd sparked widespread criticism online, with many accusing the team of poor execution and careless community management.

The Meet-Up Meta reflects both the strength and fragility of Korea’s Web3 retail culture: while offline events remain a powerful engagement tool, projects are learning that distribution strategies perceived as unfair or overly speculative can quickly erode trust within one of the world’s most active crypto markets.

Figure 6: Video from Sonic’s Korea Meetup Goes Viral

Source: @0xseg X

3.3. Listing Pump

A persistent feature of Korea’s crypto market remains the explosive “listing pump” phenomenon whenever leading exchanges like Upbit or Bithumb list new tokens. In July 2025, Hyperlane’s HYPER token surged by about 150% within hours of its Upbit debut, breaking a prior downtrend and triggering a wave of speculative attention. Similarly, API3 spiked 121% following its Upbit listing in mid-August, with trading volume soaring over 400% and its market cap doubling from roughly $100 million to over $200 million in a single day.

The most dramatic move came from CYBER, which skyrocketed by more than 150% within minutes of its Upbit listing on August 12, briefly pushing its market cap from around $80 million to nearly $170 million before retracing sharply. Smaller-cap tokens like SYRUP (+29%), MOODENG (+57%), and others also saw parabolic rallies after listing, completely overshadowing offshore volumes.

These moves underscore Korea’s uniquely retail-driven and liquidity-rich market dynamic, but they also highlight the speculative intensity: price surges are often brief and front-loaded, reinforcing the notion that listing hype continues to dominate investor behavior in the absence of sustained fundamentals.

Figure 7: $CYBER Surges Over 150% Following Upbit Listing Announcement

Source: Trading View

4. Interviews

To better understand the evolving dynamics of Korea’s crypto market, we spoke with several GTM and research-focused companies and ecosystem leaders who are shaping Web3 adoption. Among them are Four Pillars and Xangle, global research firms that bridge the gap between projects and investors.

Four Pillars - Ponyo

1. Could you briefly introduce yourself?

I’m Jaewon Kim (Ponyo), a research analyst at Four Pillars.

2. How would you describe the current market sentiment among Korean investors?

Overall, Korean investors are cautious. The fact that the “Kimchi premium” isn’t as pronounced as before shows that markets are not overheating in the short term. That said, there’s a gap between U.S. and Korean trends. Narratives that take off in the U.S. don’t always get the same traction in Korea, and sometimes it’s the other way around, with Korean themes spreading later to the U.S. On-chain native investors in their 20s and 30s follow U.S. sentiment quickly, but the broader market still shows a more careful stance.

3. What are the biggest opportunities and challenges for projects entering the Korean market?

The opportunities are clear. Korea still ranks among the top globally in trading volume, and it has investors who are quick to pick up on new trends and technologies. Especially the 20s–30s on-chain natives I mentioned earlier—they actively follow global narratives on Twitter and Telegram, which makes it relatively easy for overseas projects to reach them. The challenge, though, is the polarization of investor groups. The 40s–60s who move larger amounts of capital through Upbit don’t rely on crypto-native channels like Twitter. They use YouTube, Naver, mainstream news, or word-of-mouth networks instead. Reaching this group is much harder, which is why consistent media exposure and localized communication are essential.

4. What factors are driving retail participation and interest in new projects?

The main drivers are influencer marketing, Telegram communities, and offline meetups. Recently, Kaito has been a key tool—promotion via Kaito, amplified by influencers, has played a major role in sparking early interest in new projects.

5. What trends do you expect will shape Korea’s Web3 ecosystem over the next 12–18 months?

The direction of Korea’s Web3 ecosystem in the next 12–18 months depends on regulation. If upcoming changes (like the Digital Asset Basic Law, rules on KRW-backed stablecoins, potential ETF approvals, and allowing institutions to hold crypto assets) actually come into effect, then institutional investors will enter more seriously, and startups will be able to try a wider range of services. That would help the market expand beyond retail-driven trading into areas like defi, gaming, content, and social applications. If not, the market will likely remain stuck in the same retail-trading structure a year from now.

Xangle - KP Jang

1. Could you briefly introduce yourself?

I’m the Chief Strategy Officer and Head of Research at Xangle, Korea’s largest crypto information platform and validator operator. My role is twofold: driving our business strategy in the rapidly evolving Web3 market and leading our research center to provide data-driven insights for both institutional and retail participants. At Xangle, we aim to bridge the information gap between global projects and Korean investors by delivering transparent, reliable, and localized intelligence.

2. How would you describe the current market sentiment among Korean investors?

Sentiment is cautiously optimistic. For existing crypto-native investors, this is seen as a market full of recurring opportunities, with strong activity in trading and staking. However, it’s not yet at a stage where new retail participants are rushing in — the kind of “FOMO” that triggers mass adoption hasn’t fully returned. Retail still tends to wait for clear signals, such as strong CEX listings and visible price performance, before committing capital.

3. What are the biggest opportunities and challenges for projects entering the Korean market?

The biggest opportunity is undoubtedly the massive liquidity that Korean retail brings. Korea consistently ranks among the top global markets by trading volume, and projects that successfully localize can tap into one of the most active investor bases worldwide.

But the challenge lies in localization. Korean users behave very differently compared to Western crypto communities — they are more centralized-exchange-driven, less on-chain-native, and they expect tailored community engagement. Navigating the regulatory environment is another key challenge, as compliance and reputation matter significantly in this market.

4. What factors are driving retail participation and interest in new projects?

Retail discovery in Korea is still overwhelmingly tied to centralized exchanges. In simple terms, unless a token is listed on a major CEX like Upbit or Bithumb, most investors won’t even know it exists. I often say that in Korea, the saying “the first girl you meet feels like your ideal type” applies to crypto as well — retail tends to chase what they first see on exchanges.

Once a token is listed, price performance becomes the first filter: strong early performance attracts retail attention. After that, consistent exposure through meetups, offline events, and marketing helps sustain interest. On-chain channels, by contrast, still account for less than 1% of the investor base here.

5. What trends do you expect will shape Korea’s Web3 ecosystem over the next 12–18 months?

Two major trends stand out.

First, we expect the current wave of “yapping” communities — where investors gather for speculative chatter — to evolve into a more structured form of airdrop farming. As global projects rely increasingly on incentive-driven distribution, Korean retail is likely to become highly active in organized airdrop strategies.

Second, if a KRW-backed stablecoin were to materialize, it would be a game-changer. It could provide the foundation for Korea-specific DeFi and Web3 infrastructure, creating an ecosystem that is not only speculative but also utility-driven. This would unlock new opportunities for payments, remittances, and localized Web3 applications.