Summary

The Crypto Treasury Companies (CTCs) that have emerged in recent months aim to accumulate a wide range of assets, such as BTC, ETH, SOL, and XRP, by issuing equity (PIPE or ATM), convertible bonds, and preferred shares. Mergers and acquisitions (M&A) involving SPACs and shell companies have become a popular template for launching treasury operations.

While a global phenomenon, the U.S.-domiciled entities account for the majority of crypto treasury companies operations due to the U.S.’s robust public capital markets, which offer unparalleled breadth and depth liquidity unmatched by the capital markets in other jurisdictions.

Some CTCs may not prove to be diamond-handed, but this does not necessarily imply that the crypto market has become riskier. Managing this risk depends entirely on each CTC’s ability to anticipate its cash flow needs and structure its capital to sustain and grow crypto holdings. The market will reward those that succeed with higher NAV multiples and penalize those that fail, which is no different from assigning higher multiples to companies that deliver stronger earnings growth.

1. Introduction

The recent surge in public entities adopting crypto asset treasury operations marks the dawn of a new era in financial engineering, comparable to Leveraged Buyouts (LBOs) in the 1980s or Exchange-Traded Funds (ETFs) in the 1990s. However, this phenomenon remains poorly understood outside a small segment of the crypto industry, often oversimplified as nothing more than a “leveraged ETF trade.” Against this backdrop, this report aims to serve two purposes: first, to overview the corporate transactions that underpin this innovation; and second, to address some of the concerns raised by market participants about the rapid rise of these activities.

As the industry has yet to settle on a term for these entities (e.g., "Digital Asset Treasury Companies" or "Public Crypto Vehicles"), this report uses "Crypto Treasury Companies" (CTC) for brevity. The term refers to public entities that prioritize crypto asset accumulation as their primary driver of shareholder value, funded through public capital markets. It excludes companies whose primary value derives from conventional operations with partial crypto treasury holdings, such as Tesla, Coinbase, or Bitcoin miners. The discussion focuses primarily on U.S.-domiciled companies, given their global dominance in this space. More on this point later in the report.

2. How Crypto Treasury Operations Work

Originally a sleepy software solutions company, Strategy (MSTR, formerly MicroStrategy) has undergone a remarkable transformation, with its market value surging 100-fold in under five years. This extraordinary growth stems from its pioneering Bitcoin Treasury Operation, led by founder Michael Saylor, which leverages public capital markets to repeatedly finance BTC acquisitions.

This strategy, well-documented over the years, has inspired a wave of imitators in various shapes and forms in recent months. This section explores the types of vehicles and funding instruments used by them and provides a table summary of the current Crypto Treasury Company (CTC) landscape.

Figure 1: The Secret is Out

Source: Forbes

2.1. Vehicles

The types of public entities serving as vehicles for crypto treasury operations are summarized below. Through mergers and acquisitions, these entities can be transformed into a vehicle equipped with working capital and initial crypto assets to launch treasury operations.

Opco: Short for "operating company," this term refers to an entity focused on running a conventional business as a going concern. A low opportunity cost is typically a prerequisite for an opco to adopt crypto treasury operations, as companies with thriving businesses are unlikely to distract from their core operations to pursue this new strategy. Strategy or GameStop fall into this category.

SPAC: Short for "Special Purpose Acquisition Company," this term refers to a publicly traded entity created to raise capital through an IPO for a merger or acquisition, often without a predefined target at formation. SPACs hold IPO proceeds in trust accounts, typically in U.S. Treasury securities, until a business combination (De-SPAC transaction) is completed. As a distinct category, SPACs must comply with specific SEC regulations.

Shellco: Short for "shell company," this term denotes a non-operational entity with minimal or no significant assets or business activities, often used for financial transactions, asset holdings, or mergers. Unlike SPACs, shellcos are not specifically created for IPOs or acquisitions and may serve various purposes. They are subject to less stringent regulatory requirements than SPACs.

2.2. Funding Instruments

A defining feature of CTCs is their access to public capital markets as listed entities. While any entity, private or public, can invest idle cash in crypto assets, CTCs are distinguished by their ability to navigate public markets for funding, unlike conventional public companies or ETFs passively holding Bitcoin (BTC). The most commonly used funding instruments are summarized below:

Equity: The primary method of funding, equity issuance typically involves Private Investment in Public Equity (PIPE) or at-the-market (ATM) offerings. A PIPE entails negotiated sales to select accredited or institutional investors, often at a discount and subject to lock-up periods. An ATM offering entails public sales of shares on the open market to any investor at prevailing prices, with greater disclosure and unrestricted trading. PIPEs are discreet and targeted, while ATMs are transparent and broad-based. Both dilute existing shareholders, though PIPEs typically have a greater dilutive impact. For CTCs trading at an NAV premium, ATMs enable capitalization on this premium.

Convertible Bond (CB): CBs are well-suited for CTCs as they capitalize on the high volatility of crypto assets. The conventional view among investors is that volatility is undesirable, but the CTCs’ CB issuance turns that notion upside down, harnessing the crypto’s high volatility into a powerful fundraising tool. The embedded call option, a key driver of a CB’s value, benefits from high volatility, which increases CB’s value and enables CTCs to raise capital efficiently. For example, as a CTC’s share volatility rises due to increased crypto assets on its balance sheet, it can issue CBs at a higher conversion price (greater conversion premium), effectively selling shares higher than at prevailing market prices.

Convertible Preferred Shares: Pioneered by MSTR, convertible preferred shares represent the latest innovation to further optimize funding terms. Unlike CBs, which carry redemption liabilities, preferred shares are perpetual, like common shares, eliminating cash flow pressures from repayment obligations. By embedding convertibility into common shares, CTCs achieve the same benefits as CBs – leveraging volatility for efficient capital raising – without redemption constraints.

Straight Debts: Though no longer commonly used, straight debt is included here for completeness. In its early days, MSTR issued straight debt collateralized by its BTC holdings to fund BTC acquisitions but later retired it, recognizing the risk of forced liquidation if BTC prices fell to a liquidation threshold. Currently, none of MSTR’s BTC is pledged as collateral for outstanding debts, likely by design to avoid margin liquidation. If this happens, it would significantly erode market confidence in its ability to sustainably grow BTC holdings, a critical factor driving its premium NAV valuation. This serves as a cautionary tale when evaluating CTCs: issuing debt collateralized by crypto assets would be a red flag.

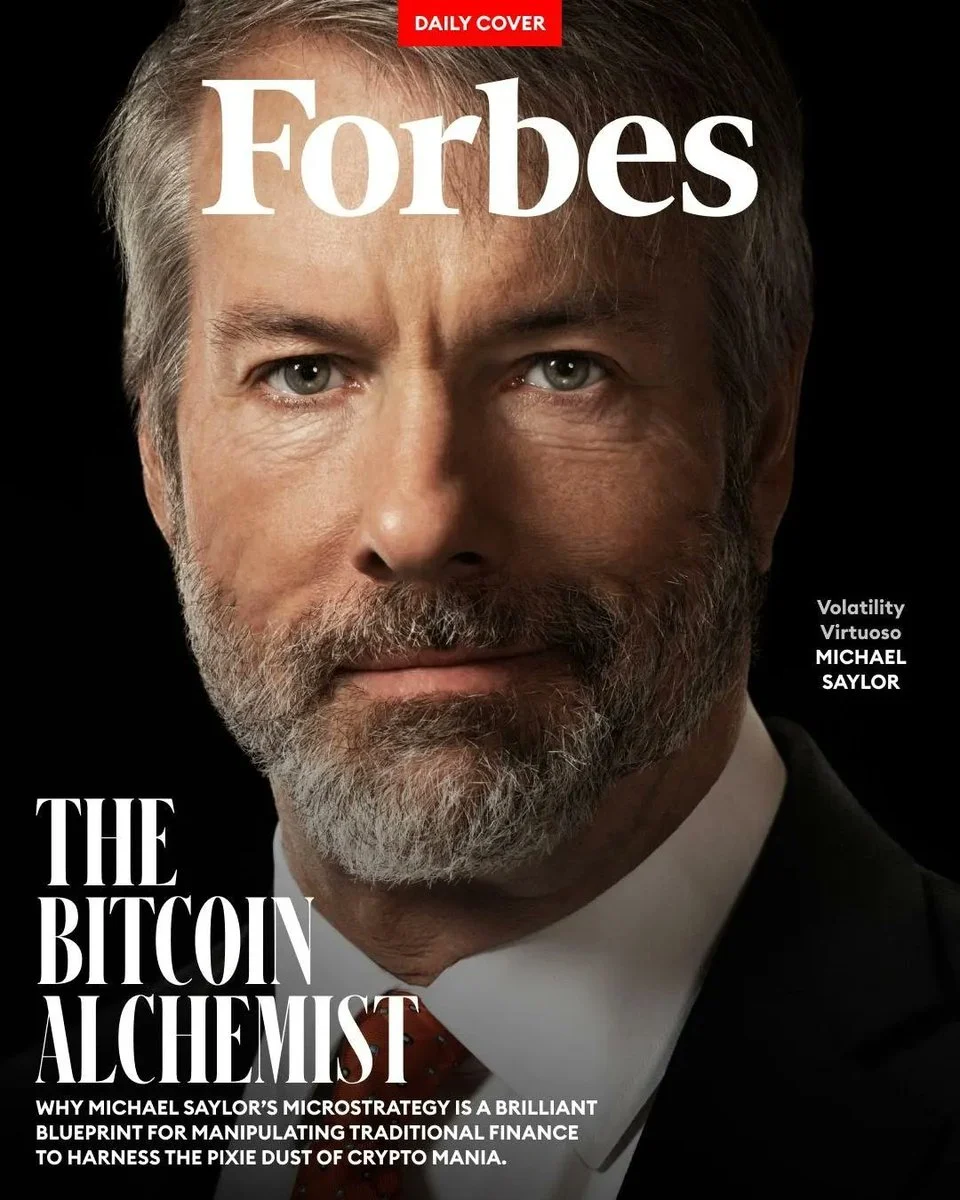

The choice of funding instrument hinges on a CTC’s stage of development. Newer entities launching treasury operations typically prefer PIPE offerings, which efficiently bootstrap their capital base. More mature CTCs, such as Strategy, GameStop, or Trump Media, often find ATM equity or CB issuance more effective, especially if the shares are valued at premiums to NAVs. The CTCs that have cultivated diverse classes of institutional investors such as MSTR can explore even more innovative instruments like convertible preferred shares to further optimize its funding strategy. Additional considerations for each instrument are summarized in Figure 2.

Figure 2: Pick Your Instrument Wisely

Source: Presto Research

2.3. U.S. Crypto Treasury Companies Landscape

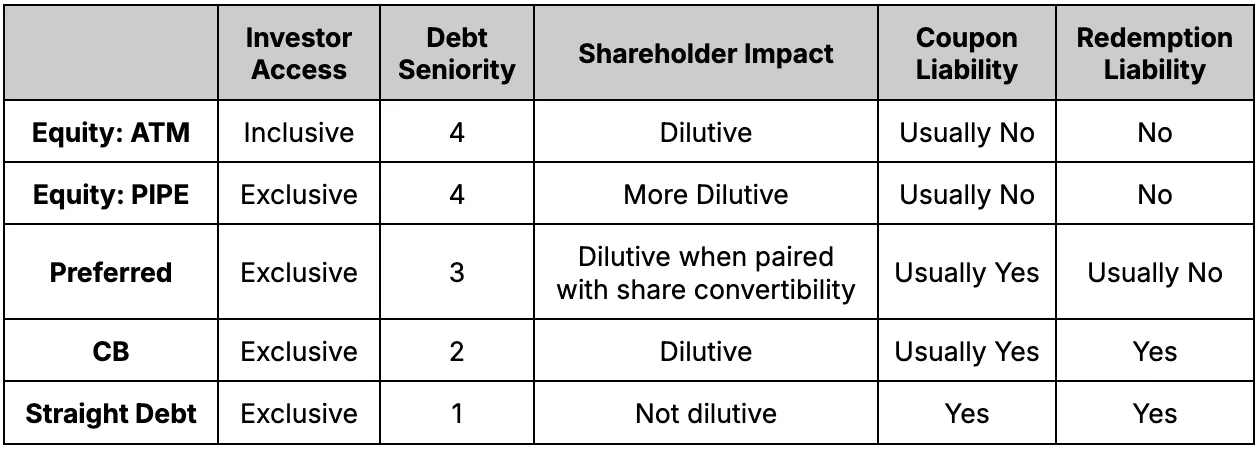

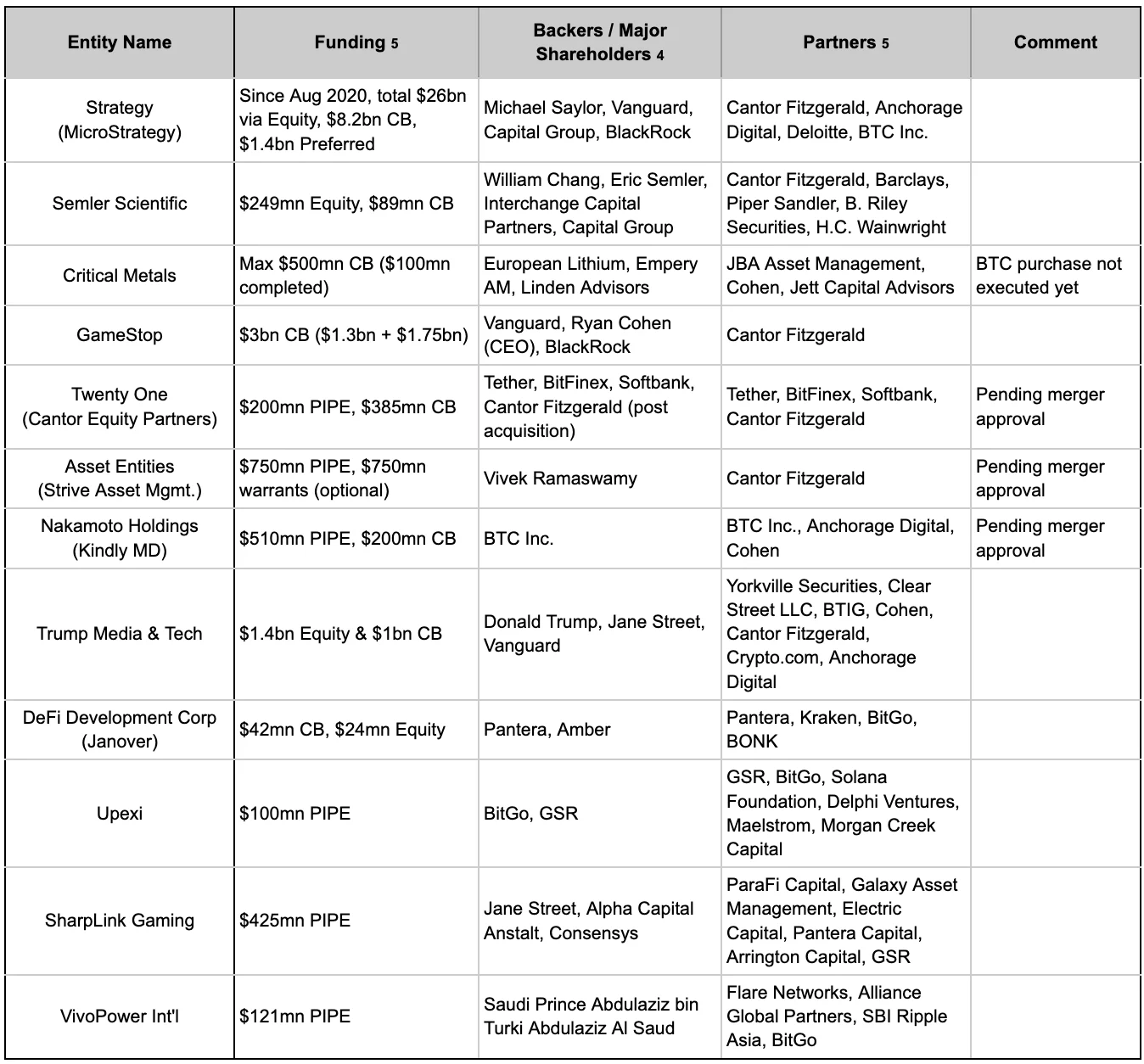

The adoption of crypto treasury operations by public entities is rapidly becoming a global phenomenon, with over 30 CTCs estimated worldwide. However, U.S.-domiciled entities account for the majority of transactions and are likely to remain that way in our view. This is due to the U.S.’s robust public capital markets, which offer unparalleled breadth and depth, supported by a sophisticated institutional investor base adept in diverse financial instruments – a combination unmatched by the capital markets in other jurisdictions. Figure 3 summarizes the key profiles of major U.S.-domiciled CTCs.

Figure 3: The State of U.S. Crypto Treasury Companies

Note:

1. All data as of June 13, 2025 (BTC $104,012, ETH $2,501, SOL $142.91, XRP $2.11)

2. Based on NYDIG, Bloomberg, Cointelegraph

3. Expected balances post financings

4. Expected major shareholders post transactions

5. Based on Coindesk, Cointelegraph, The Block, press releases

3. Addressing Risks

The rapid emergence of new CTCs has raised concerns that their leveraged crypto long positions could trigger cascading selling pressure in a bear market, reminiscent of the bankruptcies of Celsius/Genesis/Three Arrows Capital or the Terra/Luna collapse. These concerns mainly fall into two categories: collateral liquidation risk and activist liquidation risk. While partially valid, these risks are more nuanced than perceived. We examine both below.

3.1. Collateral Liquidation Risk

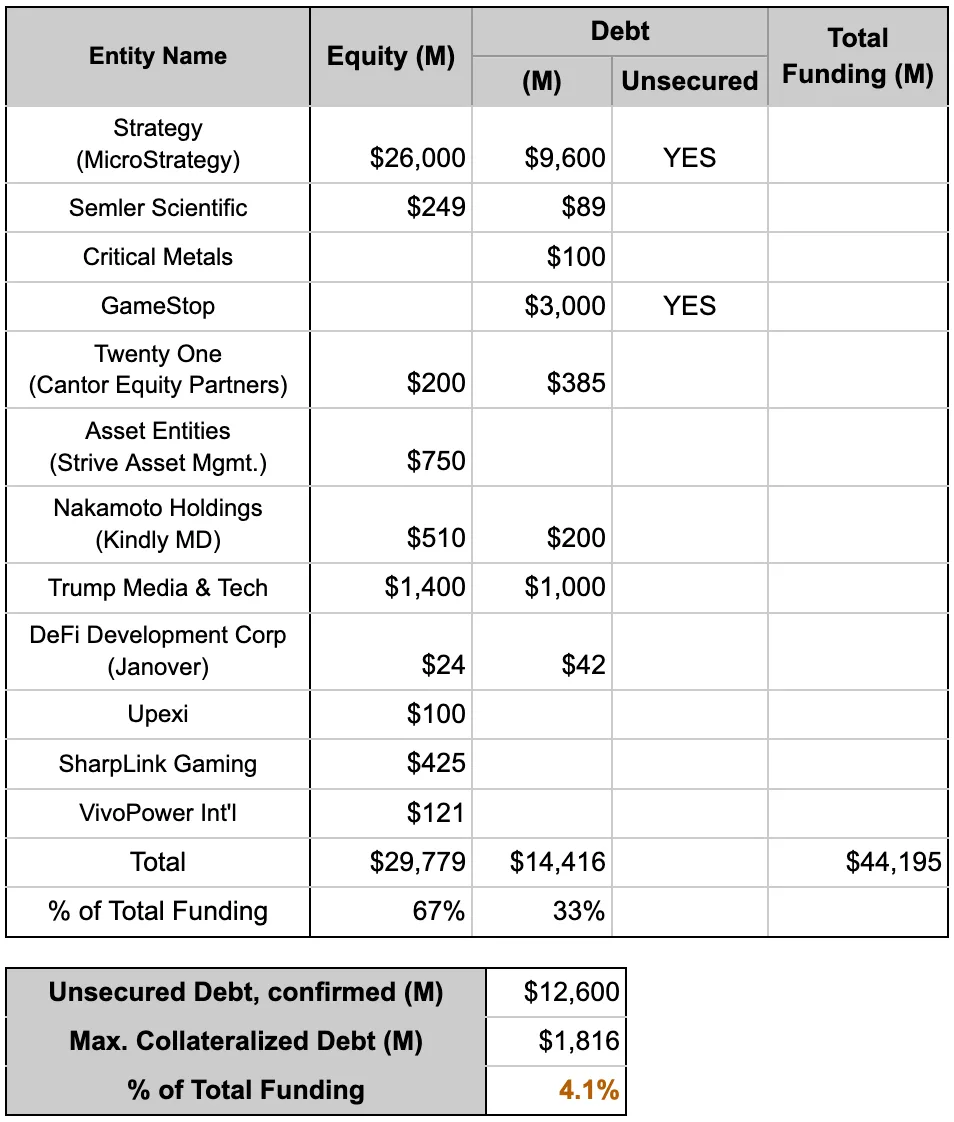

A primary concern is that, with crypto long positions financed externally, a crypto bear market could trigger margin calls, forcing CTCs to liquidate holdings and amplify downside risk. This concern would be valid if CTCs’ debts were collateralized by their crypto assets.

Closer examination reveals this is largely not the case. Of the $44 billion in capital raised or pending by the 12 CTCs referenced above, only 33% is debt-financed. Of that portion, 87% is confirmed as unsecured debt, meaning no assets are pledged as collateral. Public disclosures so far do not clarify whether the remaining 13%, or $1.8 billion, is collateralized by crypto holdings. But even assuming it is fully collateralized, this represents a fraction of the CTC’s total funding and an even smaller fraction of the $64 billion in peak leverage during the last bull cycle (4Q21), as estimated by Galaxy Research (Figure 4). If this practice is maintained, it’s unlikely that the CTC’s crypto accumulation becomes a systemic risk.

This does not imply that CTCs will never sell their crypto holdings, however. In unforeseen circumstances requiring urgent cash, with no alternative funding sources, CTCs may resort to liquidating crypto assets. Managing this risk depends entirely on each CTC’s ability to anticipate its own cash flow needs and structure its capital to sustain and grow crypto holdings. The market, in turn, would reward CTCs that succeed with higher NAV multiples and penalize those that fail. This is no different than the market assigning higher multiples to the companies who it believes can deliver higher earnings growth.

Figure 4: Collateral Liquidation Risk is Unlikely To Be A Systemic Risk

Source: Coindesk, Cointelegraph, The Block, press releases, Presto Research

3.2. Activist Liquidation Risk

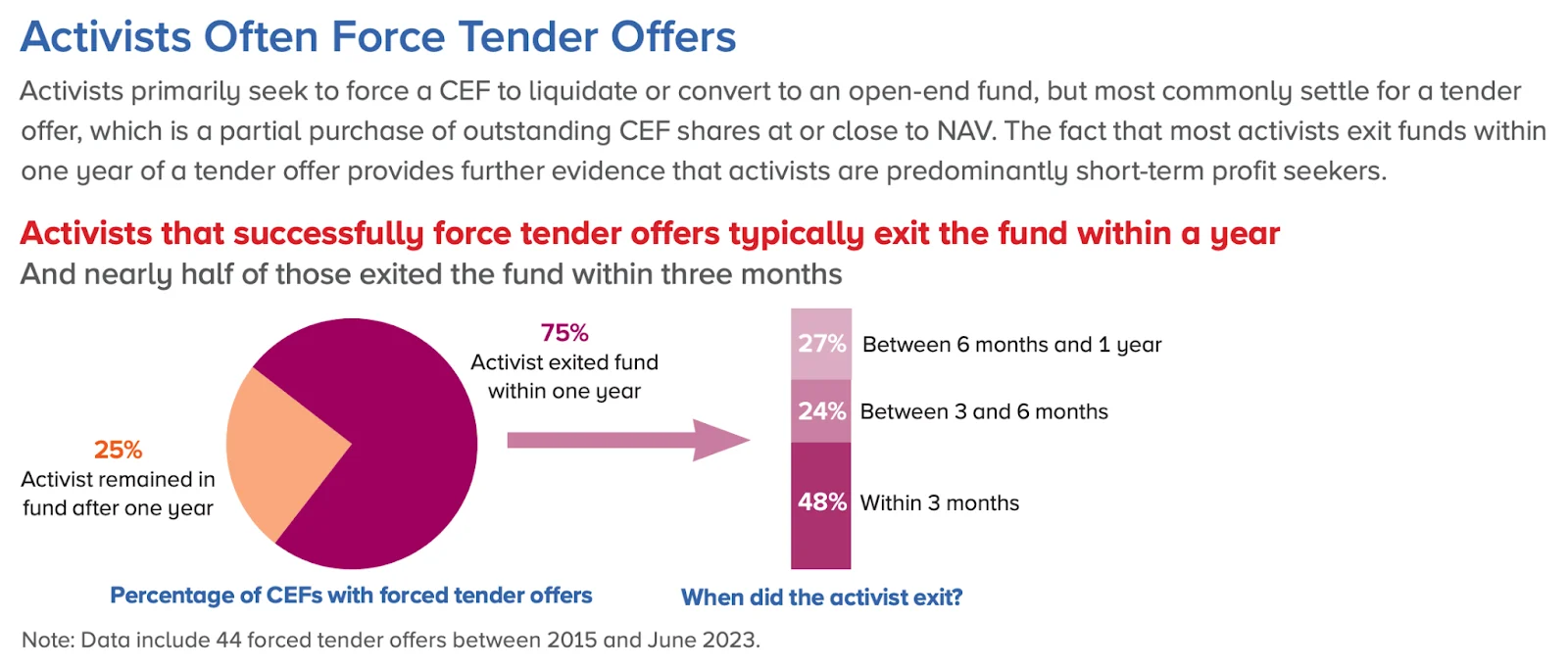

If a CTC’s ability to sustain its crypto treasury operations is questioned during a bear market, its shares may trade at an NAV discount. A persistent and significant discount could expose the CTC to an “activist attack” – a hostile takeover aimed at liquidating its crypto holdings to profit from the NAV shortfall. This risk is unlikely in the early stages of a CTC’s life cycle but may grow as CTCs issue additional shares, diluting control. CTCs with fragmented shareholder ownership would be particularly vulnerable.

The good news is that most activist investors realize gains by exiting when the NAV discount narrows, rather than pursuing liquidation. They typically prioritize NAV convergence through buybacks, tender offers, or market sentiment shifts, resorting to liquidation only as a last resort due to its high effort and cost. One study found that, between 2015 and 2023, activists exited 75% of deep-discount closed-end fund trades following successful tender offers (Figure 5).

Figure 5: Activists Don't Want Liquidation

Source: Investment Company Institute

Some commentators compare the CTC’s NAV premium to that of Grayscale Bitcoin Trust (GBTC) during the 2021 bull market, suggesting that CTCs’ premium signals speculative excess and an impending bubble burst. While an overstretched premium could indicate a bubble, the limited historical data for most CTCs makes it difficult to determine what premium level qualifies as "overstretched.” The recurring nature of the crypto asset accumulation implies some premium is justified, a concept explored in detail in Why MSTR's NAV Premium Can Go Higher.

More importantly, the GBTC comparison is flawed. Unlike GBTC, which is constrained in growing BTC per share due to its trust structure, CTCs can engage in financial engineering to increase their per share BTC holdings. Moreover, GBTC did not contribute to selling pressure during the bear market, as none of its BTC was sold until its conversion to an ETF in January 2024, well into the bull market.

4. Final Words

The financial engineering Michael Saylor has pioneered at the intersection of Bitcoin and the public capital market is nothing short of extraordinary, and will continue to inspire a growing number of firms to adopt similar strategies. Proof-of-Stake (PoS) altcoins, in particular, may attract more interest, as staking rewards could enhance CTCs’ ability to grow crypto holdings, potentially supporting higher NAV multiples for PoS-focused CTCs. While it’s still early days and valuations can fluctuate widely, early signs of this trend are already apparent in our analysis.

Having said that, navigating capital markets and managing funding needs is a complex task, and the rapid rise of CTCs will likely attract its share of inexperienced participants. In the next bear market, some may face challenges due to inadequate balance sheet management, and therefore concerns about these risks are valid.

However, this does not necessarily imply that crypto has become a riskier marketplace. Our examination shows these risks are more nuanced than often portrayed. CTCs do not fundamentally alter the market’s risk profile. Retail investors with large crypto positions have long existed, and their personal circumstances, such as unexpected financial needs from life events, could trigger liquidations, just as CTCs might. Rather, the emergence of CTCs underscores a key investment principle: the greatest challenge lies not in predicting market trends or asset performance, but in managing the unpredictability of one’s own cash flow requirements. As CTCs reshape both corporate finance and crypto market dynamics, this lesson remains critical for investors.

Figure 6: A Wise Old Man Once Said...

Source: Brainy Quote