Contents

(1) Macro Backdrop

(2) Crypto Market Moves

(3) Crypto Fund Performance

(4) Positioning and Flows

(5) Takeaways

1. Macro Backdrop

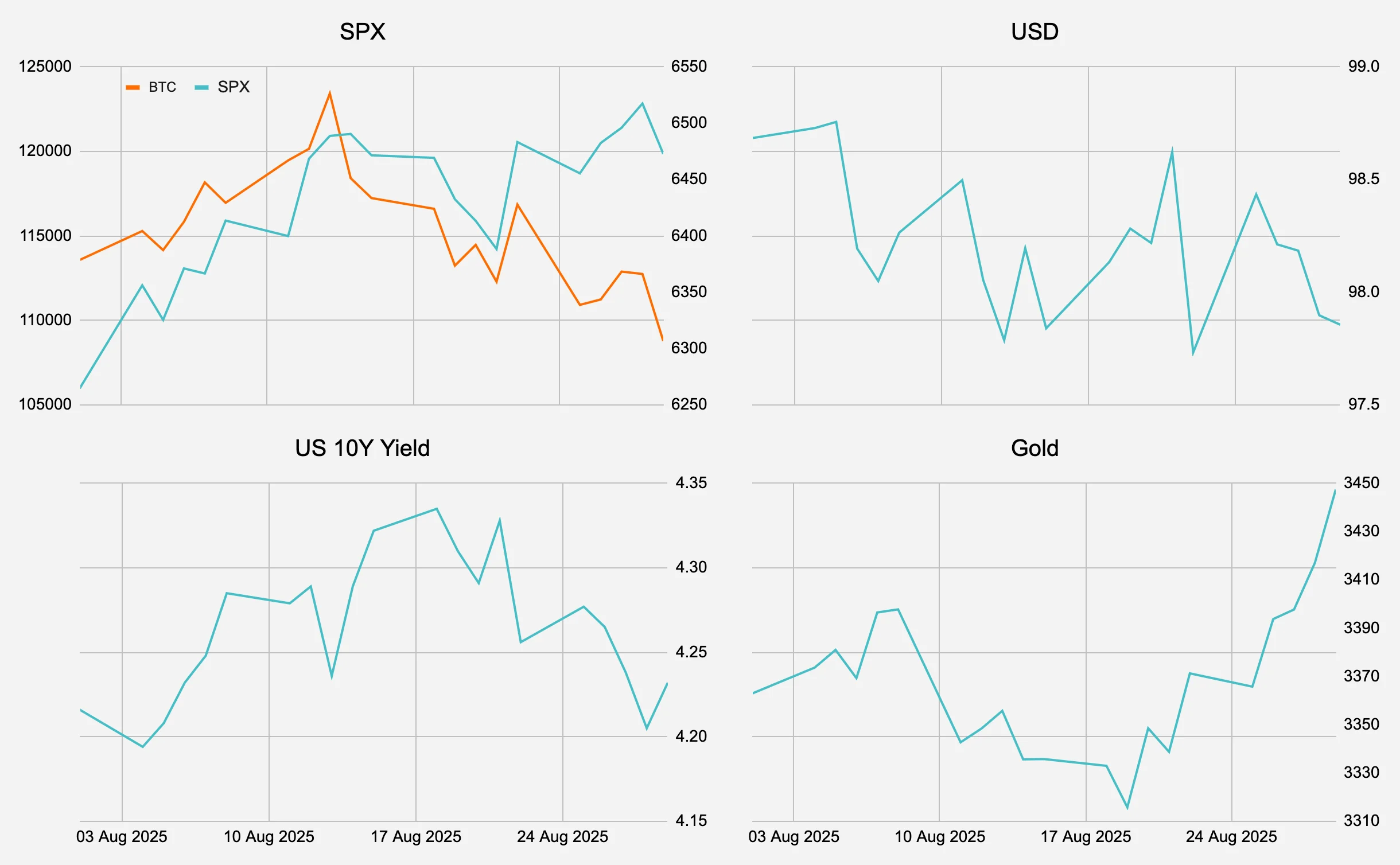

August opened against a fragile macro setting. The US announced a 10% global minimum tariff, with higher rates on surplus nations, while reciprocal measures from earlier in the year went live. The policy shift reinforced concerns around global trade and inflation. The S&P 500 (SPX) continued its upwards march while US 10Y yields climbed above 4.35% before retracing below 4.25% into Jackson Hole, where Powell struck a balanced note acknowledging labour softness but avoiding a firm policy signal. Markets finished the month pricing an 80–95% probability of a September cut.

The dollar stayed firm, with the DXY index hovering near 98, while gold rallied to $3,450/oz at month-end on safe-haven demand. Credit spreads absorbed tariff and geopolitical noise, remaining resilient across the curve.

Figure 1: August price action

Source: Presto Research

Globally, equity flows were mixed. According to the BofA Securities Equity Client Flow Trends, US and EM equities saw net inflows led by hedge funds, while retail participation softened. Sector positioning shifted defensively, with Energy and Utilities among the few sectors seeing consistent buying. At the same time, the BofA Global Fund Manager Survey highlighted a sharp rise in “long gold” as one of the most crowded trades, reflecting persistent macro uncertainty.

2. Crypto Market Moves

Crypto followed global markets with volatile two-way trade. Bitcoin climbed above $123k on 13 August before retracing to ~$111k into September. Ethereum outperformed, peaking above $4,700 before ending the month near $4,300, while ETHBTC gained early but faded into month-end. Solana (+17.7%) and other alts participated in the rotation, while Bitcoin dominance fell to 58.1% - its lowest since 2021. ETH dominance briefly cleared 14% for the first time since late 2024, reinforcing the sense of an alt-cycle rotation.

Derivative flows tracked this volatility. BTC implied vols traded between 32–40v, spiking into the mid-month rally, while ETH short-dated vols exceeded 70v at points. Skew swung from calls to puts as spot reversed. Basis remained firm at ~7–9% annualised, suggesting no funding stress despite liquidations picking up during the highs.

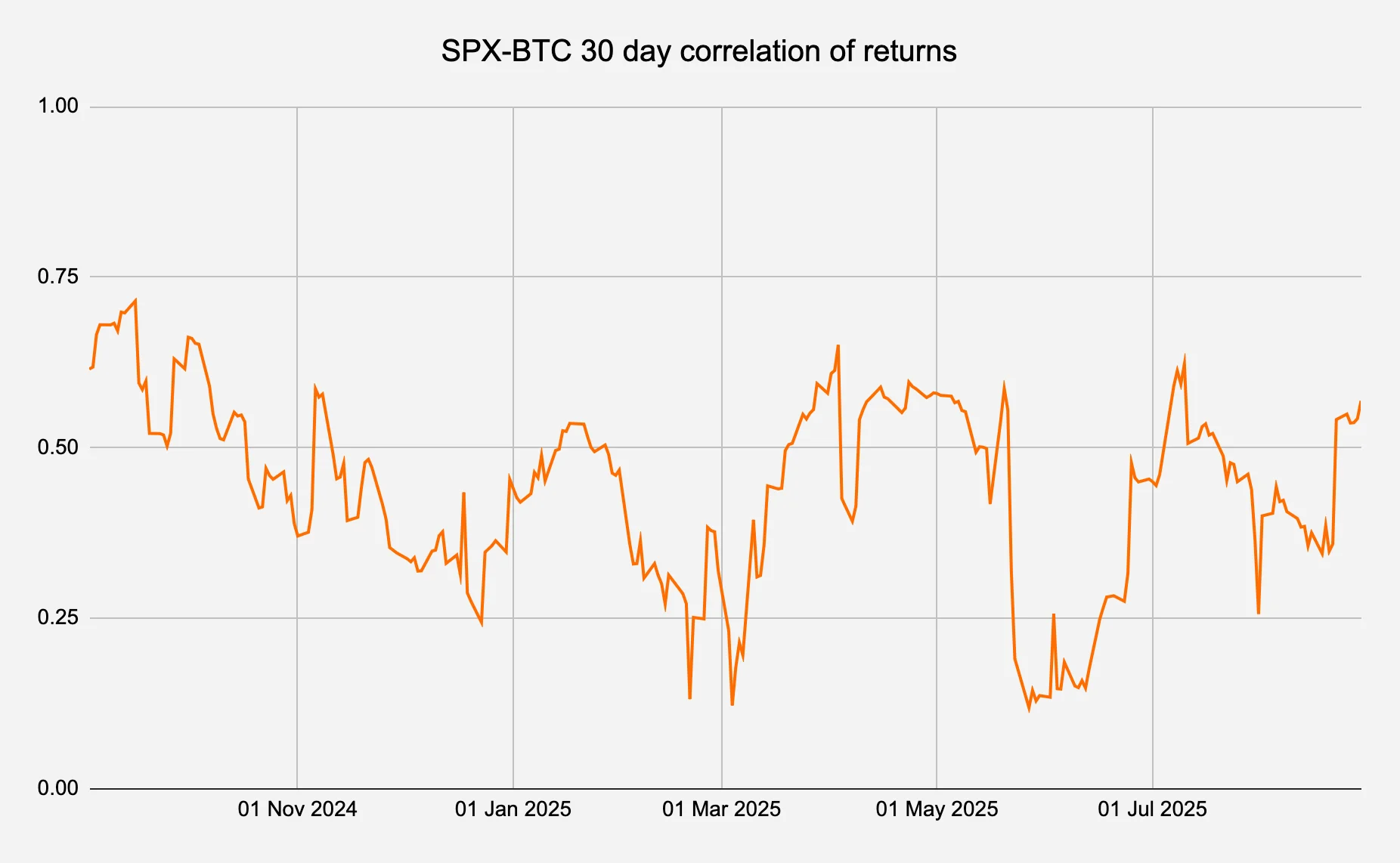

Correlation to equities stayed unstable. The 30-day rolling SPX–BTC correlation oscillated between 0.2–0.6 through August, highlighting crypto’s partial detachment from equity beta (Figure 2).

Figure 2: After decoupling, SPX-BTC correlation rose into month end

Source: Presto Research

3. Crypto Fund Performance

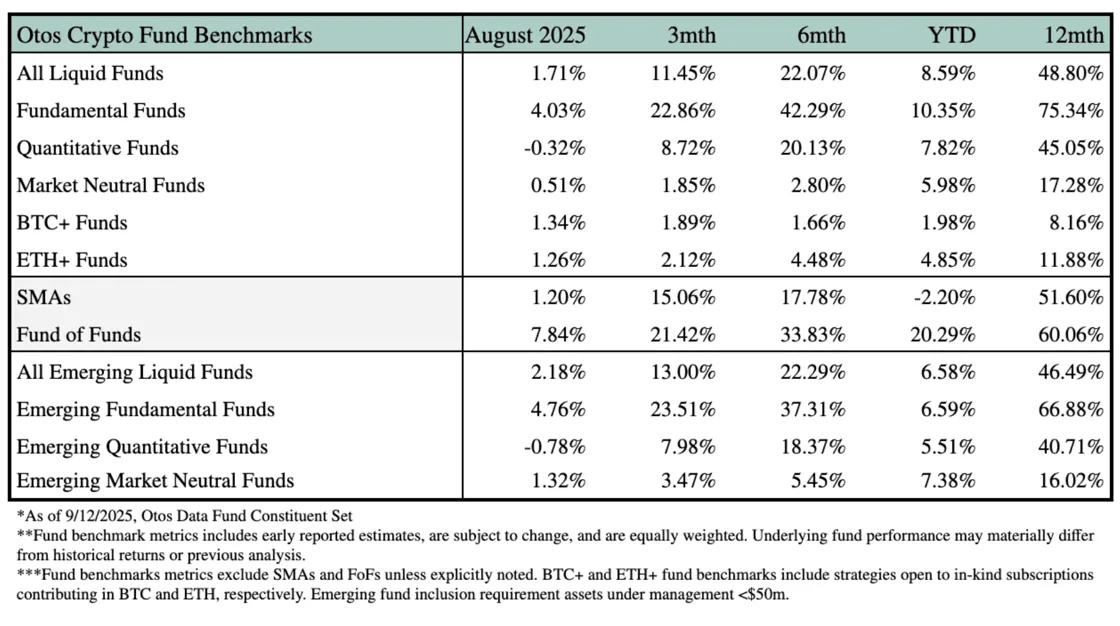

Figure 3: Fundamental funds impressed in August

Source: Otos Data

The Otos benchmarks show that crypto hedge funds weathered August better than underlying spot beta. All liquid funds gained +1.71%, outperforming BTC’s –6.5% decline and broadly matching ETH’s +18.8% tilt via strategy dispersion.

Fundamentals: +4.03%, extending YTD gains to +10.35%. These managers benefitted most from rotation into ETH and high-beta alts.

Quantitative: –0.32%, underperforming as mean-reversion signals struggled with sharp mid-month swings. Still +7.82% YTD.

Market Neutral: +0.51%, steady but lagging broader peer groups, +5.98% YTD.

BTC+/ETH+: modest gains (+1.34% and +1.26%) despite spot drawdowns, reflecting in-kind subscription structures.

SMAs returned +1.20%, but remain negative YTD (–2.20%). Fund of Funds delivered a strong +7.84%, extending YTD performance to +20.29% as allocator dispersion narrowed. Among smaller managers (<$50m AUM), Emerging Fundamental Funds gained +4.76% in August (+6.59% YTD), while Emerging Quant fell –0.78%. Emerging Market Neutral rose +1.32%, continuing to outpace larger peers YTD (+7.38%).

4. Positioning and Flows

Manager conversations throughout summer centred on demand-accruing tokens (DATs). These have dominated buy-side focus, reflecting persistent investor demand against constrained capital. The backdrop resembles early-stage credit markets: frothy, prone to narrative shifts, and highly sensitive to funding conditions. The challenge, as several managers emphasise, is building durable lending and credit infrastructure in an environment where most assets remain thinly traded and venture-like.

The BofA Global Fund Manager Survey showed the largest increase in risk appetite since late 2023, but cash levels remain elevated and conviction in equities mixed. Within crypto, that dynamic manifests as persistent inflows into ETH and alt vehicles even as BTC consolidates. The August Otos benchmarks confirm this rotation: fundamentals led, quants lagged, and allocators concentrated into differentiated strategies.

5. Takeaways

August was a month of consolidation across global risk and crypto. Macro remained tariff-driven, with equities and credit steady but yields heavy and the dollar bid. Crypto repriced sharply after exuberant highs, with ETH and alts taking leadership from BTC. Fund strategies outperformed underlying beta, led by fundamental managers and allocator portfolios, underscoring the benefits of dispersion and rotation.

Looking ahead, September brings a crowded catalyst path: tariffs, labour data, and the FOMC in macro; alongside structural crypto flows, DAT funding narratives, and continued capital rotation into ETH and alt ecosystems.